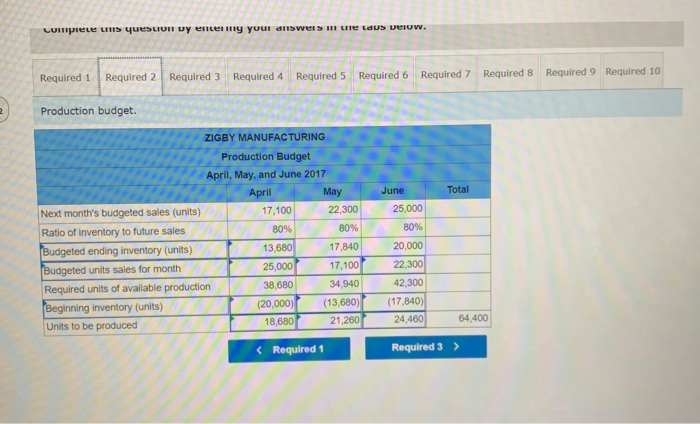

With this kind of scoring pattern, the candidate is adjudged on the grounds of knowledge levels, skills, and analytic approach. The CPA exam scoring is done on an independent basis for every candidate. US CPA Exam Question TypesĦ2 MCQs, 4 task-based simulations and 3 written communications tasks

CPA Course Exam and pass ratesĬPA exams consist of following four parts that take a total of 16 hours to be completed. The CPA application fees should be submitted with the application and the other required documents. Once you have analyzed the minimum eligibility criteria for the jurisdiction you wish to apply for, you need to pay the CPA application and examination fees.

Dose cpa study material tax deductible license#

Once you have cleared the uniform CPA exam with a minimum passing score of 75, you are eligible for a license as a CPA and can start the application process for a CPA license. Sometimes, the most tedious part of writing an exam is not the study but the application process! Application for the CPA exam is a different process from applying for a CPA license. This gives a great advantage to a CPA when working with US Based Financial firms or Indian firms working for US clients. In addition to the CA qualification, a CPA will have knowledge of US GAAP, GAAS and US federal taxation and business laws.

Academic Excellence: A CPA qualification is similar to the Indian CA qualification.Must do for CA, M.Com and Commerce Graduates: There are very few International certifications that you can give along with our job and get such high job potential.Flexibility & Ease: It’s a Single Level Online exam with just 4 Papers one can easily clear the exams in less than a year.Careers Opportunities: After passing the CPA exam candidates start their career with accounting & Auditing Firms, Research firms, Investments banks, Hedge Funds, Private equity firms, Commercial banks, Mutual funds, Merger & Acquisition etc.The exam is administered by the AICPA, which is the world’s largest accounting body. International Recognition: Excellent opportunity for CA, ICWA, CS, LLB, MBA (Finance), M.com and Commerce Graduates who aspire for an International Certification.Listed below are the detailed benefits of CPA course. The CPA course is considered as the ultimate qualification that has unlimited possibilities to show your potential in the accounting field. Candidates need to concentrate more on exam content provided by Becker to score more marks in the examination. The CPA exam question paper covers multiple choice questions, written communication and task based simulations.

Dose cpa study material tax deductible download#

Here is the direct links to download the AICPA revised new syllabus 2019 Huge number of aspirants are preparing for the Certified Public Accountant (CPA) in various countries.

A Certified Public Accountant (CPA) is the highest standard of competence in the field of Accountancy across the globe.

0 kommentar(er)

0 kommentar(er)